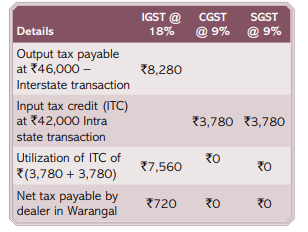

Q. A distributor of appliances in Hyderabad (T.S) purchased a TV for $₹ 40,000$ from a company in Hyderabad and supplied it to a dealer in Warangal (T.S) for $₹ 42,000$. This refrigerator was sold by the Warangal dealer to an end-user in Amaravati (Andhra Pradesh) for $₹ 46,000$. If the rate of GST is $18 \%$ calculate, (i) The net IGST, CGST, and SGST payable by the dealer in Hyderabad.

Goods and Services Tax (G.S.T.)

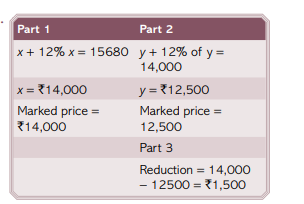

Solution: